A Comprehensive Guide on What to Study to Become a Financial Advisor

Choosing the path to become a Financial Advisor opens a world of opportunities in the growing finance sector. This comprehensive guide highlights the significant areas of study one needs to venture into to make headway in this career path.

Financial Planning/Economics/Accounting

These are the three cornerstone fields for any aspiring Financial Advisor. Financial planning equips students with the requisite knowledge on how to create sensible and efficient wealth management strategies. A solid foundation in Economics provides an understanding of market systems, economic principles and theories important for financial advising. An education in Accounting enables one to understand and interpret financial documents and plat crucial roles in fiscal management and budget planning.

Business/Finance Degrees

Completing a degree in Business or Finance could be beneficial in giving a broad perspective about the workings of the business world. These degrees also generally include diversity of sub-disciplines like investments, financial markets, corporate finance, and financial risk management. More importantly, they train you in decision-making, problem-solving, and also develop your interpersonal and communication skills.

Certifications and Licenses

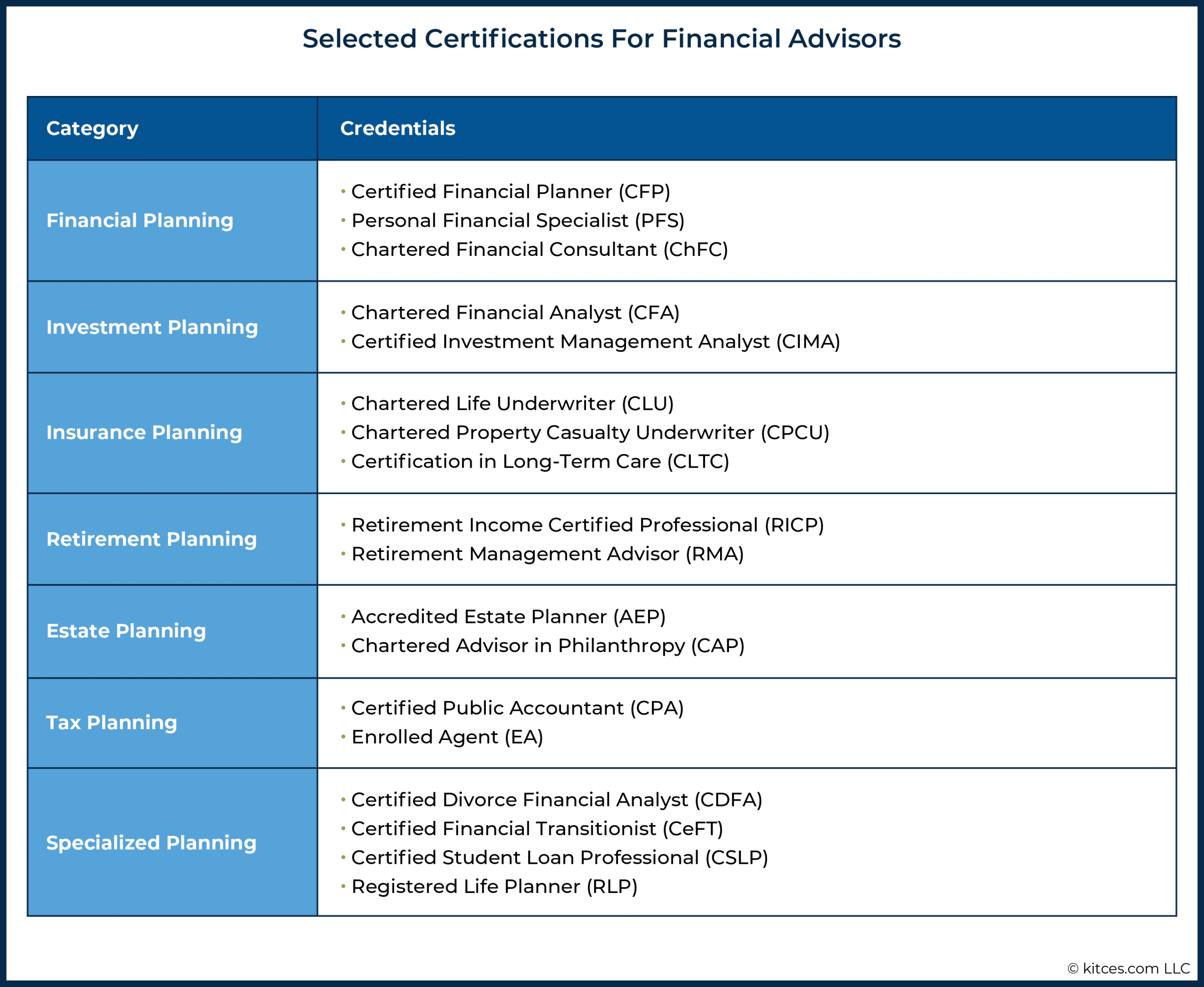

After completing your degree, the journey doesn’t end there. You should consider pursuing relevant certifications and licenses like Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), and Personal Financial Specialist (PFS). These credentials add to your credibility and are usually mandated by most employers.

Understanding the Role of a Financial Advisor: What does it Involve?

A financial advisor is a seasoned professional that offers personalized financial advice and services to both individuals and businesses. The primary task of a financial advisor is to comprehend the financial needs of a client and recommend suitable solutions.

Understanding Money: What are Finances and How They Impact Your Life

Understanding Money: What are Finances and How They Impact Your LifeDuties and Responsibilities

A financial advisor’s role is far-reaching and involves a multitude of responsibilities. Some of the significant responsibilities include financial planning, assisting in investment decisions, tax services, and providing retirement planning. They are also instrumental in offering insurance and estate planning advice.

Benefits of Engaging a Financial Advisor

- Expert Guidance: An experienced financial advisor provides expertise that helps in formulating a robust financial plan suited to an individual’s needs.

- Saving Time: Financial planning can be complex and time-consuming. Hiring a financial advisor can help save valuable time.

- Risk Management: Financial advisors assist in managing investment risks by opting for diversified investment options.

How to Choose a Financial Advisor

To ensure the right choice of a advisor, it is vital to consider factors such as credentials, experience, service levels, and payment structures. It is also recommendable to schedule a consultation to evaluate whether their services align with your financial goals and circumstances.

Essential Education: What Course Should You Pursue to Become a Financial Advisor?

Becoming a Financial Advisor requires a comprehensive education background. First and foremost in importance is a solid foundation in finance, economics, and accounting. These key areas provide vital knowledge and skills that are essential for understanding the dynamics of the financial market.

Undergraduate Degree

A typical pathway to becoming a financial advisor begins with earning an undergraduate degree. While there isn’t a specific major that’s required to become a financial advisor, programs in finance, economics, or business could be advantageous. These programs offer in-depth knowledge about financial principles, business leadership strategies, and economic theories, which are imperative for this career path.

Master’s in Business Administration

A Master’s in Business Administration (MBA) further sharpens the skills needed for this profession. It provides a broader business perspective and helps to boost your competitiveness in the job market. However, while having an MBA is a strong plus, it isn’t a strict requirement for every financial advisor job.

Understanding Money: What are Finances and How They Impact Your Life

Understanding Money: What are Finances and How They Impact Your Life Complete Guide to Understanding Everything About Credit History

Complete Guide to Understanding Everything About Credit HistoryCertification and Further Education

Lastly, many financial advisor roles require or strongly prefer candidates to have certain forms of certification. The Certified Financial Planner (CFP) designation is particularly respected. It requires passing an exam and continuing education to stay current with changes in the financial industry.

Skills and Certifications: Enhancing Your Journey to Become a Financial Advisor

The path to becoming a financial advisor requires not only a solid educational background in finance, but also a well-rounded set of skills and relevant certifications. These complements to your learning journey can significantly enhance your professional credibility and career prospects.

Essential Skills for Financial Advisors

Successful financial advisors typically possess a blend of analytical, interpersonal, and decision-making skills. Analytical skills are crucial for understanding and interpreting complex financial data, while interpersonal skills are vital for effective communication with clients. Decision-making skills, on the other hand, guide informed, wise financial planning and investment choices.

Certifications to Boost Your Financial Advisory Career

Highly-valued certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Certified Public Accountant (CPA) can differentiate you from other financial advisors. These recognitions require stringent examinations and demonstrate your extensive knowledge and commitment to the finance field. Possessing these certifications can help build client trust and lead to more career opportunities.

Finding the Balance

Strengthening the blend of relevant skills and earning notable certifications are integral to any aspiring financial advisor. This mix not only boosts your professional standing but also equips you to offer superior financial advice and guidance. Success in this field rests on maintaining a balance between these two crucial aspects.

Understanding Money: What are Finances and How They Impact Your Life

Understanding Money: What are Finances and How They Impact Your Life Complete Guide to Understanding Everything About Credit History

Complete Guide to Understanding Everything About Credit History Top 10 Proven Ways to Make Money Online: A Comprehensive Guide

Top 10 Proven Ways to Make Money Online: A Comprehensive GuidePractical Advice and Tips on How to Build a Successful Career as a Financial Advisor

To establish a successful career as a financial advisor, it is crucial to follow some practical advice and necessary steps. Accurate knowledge and the right set of skills are the key pillars to stand upon in this field.

Obtain Relevant Education and Credentials

The journey of becoming a successful financial advisor starts with obtaining an appropriate educational background. Consort to a bachelor’s degree in finance, economics, business, or a related field. Further, earning credentials such as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) can significantly boost your credibility in the eyes of potential clients.

Garner Practical Experience and Develop Core Skills

After successful completion of educational prerequisites, gaining solid work experience is the next key step. Whether you work in a bank, a financial firm or an insurance company, each experience will enhance your understanding of the financial industry. Aside from this, developing essential skills such as problem-solving, analytical thinking and excellent communication skills is paramount in building a prosperous career as a financial advisor.

Network and Build Clientele

Finally, a significant part of being a successful financial advisor lies in your ability to network and build a strong client base. Attend networking events, seek referrals, and leverage social media platforms to connect with potential clients. It is essential to build a strong rapport with your clients as trust is a vital factor in this profession.

Understanding Money: What are Finances and How They Impact Your Life

Understanding Money: What are Finances and How They Impact Your Life Complete Guide to Understanding Everything About Credit History

Complete Guide to Understanding Everything About Credit History Top 10 Proven Ways to Make Money Online: A Comprehensive Guide

Top 10 Proven Ways to Make Money Online: A Comprehensive Guide Unveiling the Best Financial Expert in the World: Who Tops the List?

Unveiling the Best Financial Expert in the World: Who Tops the List?