Introduction: Understanding The Financial Potential of Becoming a Trader

In this age of rapidly expanding technology and internet-based businesses, the world of trading has become more accessible than ever. However, before diving headfirst into this realm, it’s crucial to understand the financial potential that becoming a trader entails.

Being a successful trader involves strategic planning, intensive research, and a risk-tolerance that allows the flexibility to seize opportunities while mitigating financial threats. Traders can span forex markets, stocks, commodities, and much more. Each of these sectors offers its unique potential for generating income.

The Financial Opportunity

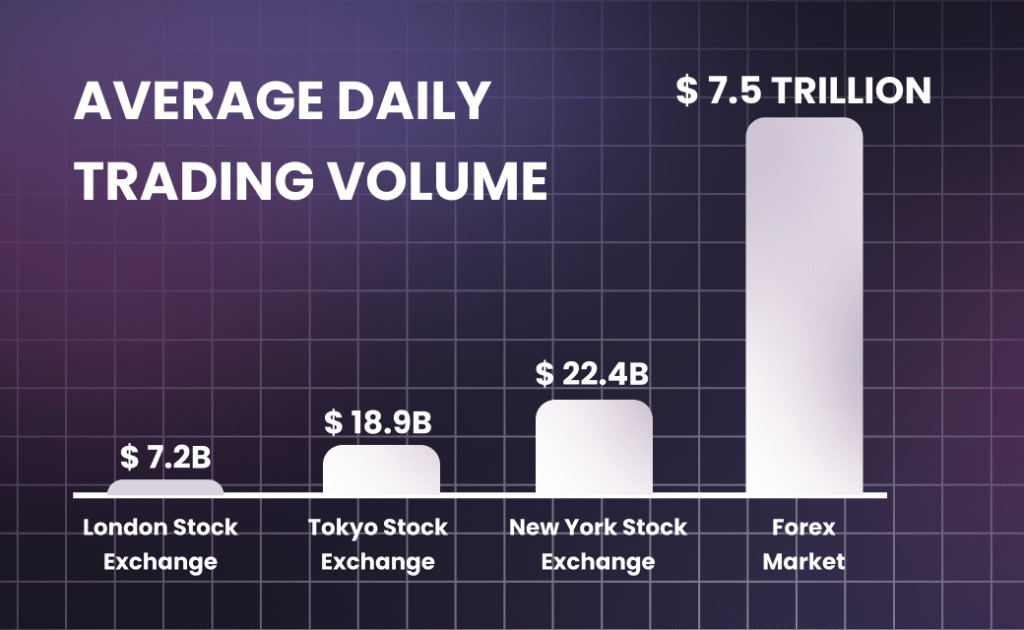

The financial potential of trading is vast and, with the appropriate strategies, can lead to significant returns on investment. With the daily trillion-dollar volume of the forex market, for instance, slight price movements can equate to substantial profits. Trading stocks also offer lucrative opportunities, especially with the increasing number of IPOs and startups. However, it is paramount to conduct diligent research and follow market trends to understand these sectors’ volatility.

The Role of Risk in Trading

Arguably, trading is equally about managing potential losses as it is about realizing gains. Risk management is a critical component of understanding the financial potential of becoming a trader. Traders must be prepared for both the highs and lows of this volatile market, adjusting their strategies accordingly.

How Much Money Do Professional Traders Make a Month?

The earning potential of professional traders varies greatly and hinges on many factors. The most crucial variables are the trader’s skill level, the amount of capital they’re working with, and the market’s performance.

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros?

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros?Trading Skill Level

Those new to trading typically earn less than established professional traders. Newcomers often make around a few hundred dollars to a couple of thousand dollars per month. In contrast, experienced traders with honed strategies can earn anywhere from five to six figures monthly.

Investment Capital

Expectantly, the more capital a trader invests, the higher their potential for big earnings. For example, a professional trader investing $10,000 will have a higher earnings potential than a trader who invests $1,000, assuming all other conditions remain constant.

Market Performance

Regardless of skill and investment capital, market fluctuations significantly impact a trader’s earnings. During bear markets, even the most experienced traders might struggle to make profits. On the other hand, bull markets, characterized by prices rising, often present an opportunity for increased earnings.

Factors Influencing A Trader’s Monthly Earnings

Understanding the various factors influencing a trader’s monthly earnings is crucial for both new and experienced players in the financial market. Traders’ income can be drastically influenced by a collective set of factors, including market conditions, trading strategy, amount of capital, and the trader’s skill level.

Market Conditions

One of the more obvious factors affecting a trader’s monthly earnings are the market conditions. Higher volatility often presents greater opportunities for profit, as price changes can rapidly create beneficial trades. On the other side, it also increases the likelihood of losses. Market trends can also impact the trader’s profitability. Understanding these trends is crucial to choosing the right positions and managing risks effectively.

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros?

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros? Exploring the Reasons: Why Am I Not Profitable in Trading?

Exploring the Reasons: Why Am I Not Profitable in Trading?Trading Strategy

Another vital component to consider is the trader’s trading strategy, which influences decision-making during trading sessions. Consistency is key in trading; it is important to adhere to a clear, well-structured plan rather than impulsively jumping on every perceived opportunity.

Capital and Skill Level

Lastly, the amount of capital a trader has and their skill level can predominantly affect monthly earnings. More capital allows for larger investment opportunities, while a higher skill level generally correlates to better decision-making and risk management, thus leading potentially to higher profits. However, it’s worth noting that more money does not always lead to higher returns.

Can You Becoming a Millionaire by Trading? Real Stories of Successful Traders

Being a millionaire might seem like a lofty goal, but a multitude of successful traders have indeed managed to achieve this feat purely through trading. The path to success is often paved with the right investment strategies, meticulous planning, and an unflinching determination to take calculated risks in the world of stocks, commodities, and currency trading.

It’s necessary to note that trading isn’t a simple ticket to prosperity. It asks for an extensive focus on market trends, high emotional quotient to manage risks, and consistent efforts to increase your market knowledge. However, the stories of successful traders who have made a mark in the trading industry can serve as inspirations.

Story of a Trader who turned a Few Thousand Dollars into Millions

One such example is the story of Richard Dennis, a name synonymous with success in the trading world. He started with a loan of just a few hundred dollars which he turned into an incredible fortune of nearly $200 million in about ten years. Dennis demonstrated that with a solid strategy, disciplined approach, and the right mindset, it is possible to achieve extraordinary financial returns through trading.

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros?

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros? Exploring the Reasons: Why Am I Not Profitable in Trading?

Exploring the Reasons: Why Am I Not Profitable in Trading? Understanding the Basics: What is Trading and How Does It Work?

Understanding the Basics: What is Trading and How Does It Work?Keys to Success in Trading

- Education: Learning the fundamentals of trading and developing an understanding of the markets is paramount.

- Strategy: Successful traders always have a clear and well-tested trading strategy.

- Dedication: Trading isn’t a get-rich-quick scheme. It requires persistent and consistent efforts over time.

Trading, while potentially profitable, is also loaded with risks. However, as demonstrated by the likes of Dennis and many others, with the right approach, becoming a millionaire is certainly within the realm of possibility.

Guidance and Tips to Maximize Your Earnings as a Trader

The world of trading is one filled with excitement, opportunities, and potential to generate impressive earnings. However, without the right approach and understanding, it might prove challenging to tap into these potentials and maximize your earnings. Therefore, we present crucial guidance and tips every trader needs to thrive and maximize earnings.

Invest in Education

Delving into trading without adequate knowledge can lead to costly mistakes. Investing in quality education, such as online courses, books, or seminars can give you the edge over other traders. Understand different trading strategies, comprehend market trends, and learn how to analyze charts and reports. Continual learning is the key to becoming a successful trader.

Use Effective Trading Strategies

Adopting proven and effective trading strategies can immensely increase your chances of success in the trading market. Strategies like trend following, scalping, and position trading can be very helpful. However, it is essential to tailor these strategies to your specific trading goals and risk tolerance.

Allow for Losses

No matter how proficient a trader you become, losses are inevitable in trading. The ability to accept losses and move on is indeed a hallmark of successful traders. Always adhere to stop-loss orders to limit your potential losses and protect your capital. Remember, the goal is not to win every trade but to have your earnings outweigh your losses over the long run.

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros?

Maximizing Your Investment: How Many Bitcoins Can I Buy with 100 Euros? Exploring the Reasons: Why Am I Not Profitable in Trading?

Exploring the Reasons: Why Am I Not Profitable in Trading? Understanding the Basics: What is Trading and How Does It Work?

Understanding the Basics: What is Trading and How Does It Work? La Evolución de la Publicidad: Cómo y Cuándo se Creó la Publicidad Moderna

La Evolución de la Publicidad: Cómo y Cuándo se Creó la Publicidad Moderna