Understanding What Trading Is

Trading refers to buying and selling assets in an attempt to profit from price fluctuations. This can happen across numerous financial markets, including stocks, commodities, and foreign exchange (FOREX). In trading, asset prices are influenced by various factors, such as the financial condition of businesses, changes in economic policy, and shifts in global economies.

Types of Trading

There are several types of trading based on the time span between buying and selling assets. These include Day Trading, where trades are conducted within a day, Swing Trading, where trades are held for several days to weeks, and Position Trading, where traders hold their positions for months or years.

- Day Trading: Traders aim to benefit from short-term price movements in the market. These trades occur within one market day.

- Swing Trading: Trades are held for several days to weeks, aiming to profit from price changes during this period.

- Position Trading: A longer-term strategy where traders hold their positions for months or years.

Key Principles of Trading

Successful trading depends on understanding and applying key trading principles. These principles include risk management, where traders should only risk a small percentage of their trading capital on each trade, and market analysis, which involves studying market trends and economic indicators to predict price movements. Knowledge, patience, and discipline remain crucial factors in trading.

Key Principles of How Trading Works

Trading, in its most basic form, involves the buying and selling of goods and services, with the aim to make a profit. The process of trading is intertwined with key principles which every burgeoning trader must be acquainted with. This blog aims to shed light on these essential components to provide you with a solid foundation in trading.

Supply and Demand

The first principle to grasp in trading is supply and demand. This principle asserts that the price of an asset is directly determined by the level of supply and demand. Basically, if the demand for a certain product increases and supply remains unchanged, a shortage occurs, leading to higher equilibrium prices.

Understanding the Risks: How Safe is Trading in Today’s Financial Market?

Understanding the Risks: How Safe is Trading in Today’s Financial Market?Risk Management

Risk management is another crucial principle in trading. It involves recognizing potential risks and implementing strategies to mitigate them. This could involve setting stop-loss orders to prevent substantial losses, or diversifying your portfolio to spread the risk.

Market Trends

Lastly, understanding market trends is an invaluable principle in trading. Traders use various indicators and patterns to predict future price movements. Whether it is an uptrend (rising prices), downtrend (falling prices), or sideways trend (prices are stabilizing), understanding these trends can aid traders in making informed decisions.

Different Types of Trading: Forex, Stocks, Crypto and More

With the digital age reaching new heights, various types of trading have emerged and evolved. Among them Forex trading, stock trading, and cryptocurrency trading or simply crypto trading, are a few models of exchange that have gained prominence in the current marketplace.

Forex Trading

Forex or Foreign exchange trading is a global marketplace for exchanging national currencies against one another. As the marketplace where the entire world’s currencies trade, Forex is considered the largest and most liquid market in the world. It offers 24/7 trading opportunities because of the time difference between various countries.

Stock Trading

Stock Trading, on the other hand, involves buying and selling shares of individual companies. In this type of trading, prices are influenced by the economic health of the company, market sentiment and overall economic trends. This form of trading has been a traditional method and has proven to be a solid investment over time.

Understanding the Risks: How Safe is Trading in Today’s Financial Market?

Understanding the Risks: How Safe is Trading in Today’s Financial Market? Unveiling the Secrets: Who is the Most Profitable Trader in the World?

Unveiling the Secrets: Who is the Most Profitable Trader in the World?Crypto Trading

The last decade has seen an explosion in crypto trading, with the advent of digital currencies like Bitcoin, Ethereum, and many others. Crypto trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. The volatile nature of cryptocurrencies makes them a high-risk, high-reward trading asset.

Guide to Successful Trading: Top Strategies and Tips

If you are on the hunt for successful trading strategies, you have landed on the right page. This guide will elucidate some top strategies and tips for successful trading, which can equip you with the necessary knowledge to make calculated decisions in the trading arena.

Embrace the Trend

One of the most common pieces of advice given to traders is to «trend-follow». Trend-following is an investment strategy that aims to capitalize on momentum within a market. This strategy involves identifying a trend, finding opportunities to enter the market in the direction of the trend, and then holding on until the trend eventually changes or begins to lose momentum.

Always Have a Plan

A successful trader always has a trading plan. A trading plan is an organized approach to execute a trading strategy that you’ve developed based on your market analysis and outlook. It covers your strategy, your tactics, and your performance measures. It’s important to stick to the plan that you make to minimize irrational behavior.

Manage your Risks

Another integral part of trading is risk management. This is the practice of identifying potential risks in advance, analyzing them, and taking corrective steps to reduce your risk exposure. It’s a vital part of your trading plan and is something we’d recommend as part of a successful trading strategy.

Understanding the Risks: How Safe is Trading in Today’s Financial Market?

Understanding the Risks: How Safe is Trading in Today’s Financial Market? Unveiling the Secrets: Who is the Most Profitable Trader in the World?

Unveiling the Secrets: Who is the Most Profitable Trader in the World? Descubre Cuáles son las Mejores Estrategias de Trading para Maximizar tus Ganancias

Descubre Cuáles son las Mejores Estrategias de Trading para Maximizar tus GananciasHow to Start Trading: Steps to Your First Trade

Entering the world of trading isn’t as complex as it may seem, especially if you follow some rudimentary steps. Before you plunge into the trading market, understanding the necessary processes and requisites involved is essential. As a beginner, you must be aware that trading requires not just basic knowledge but a level of expertise which develops over time.

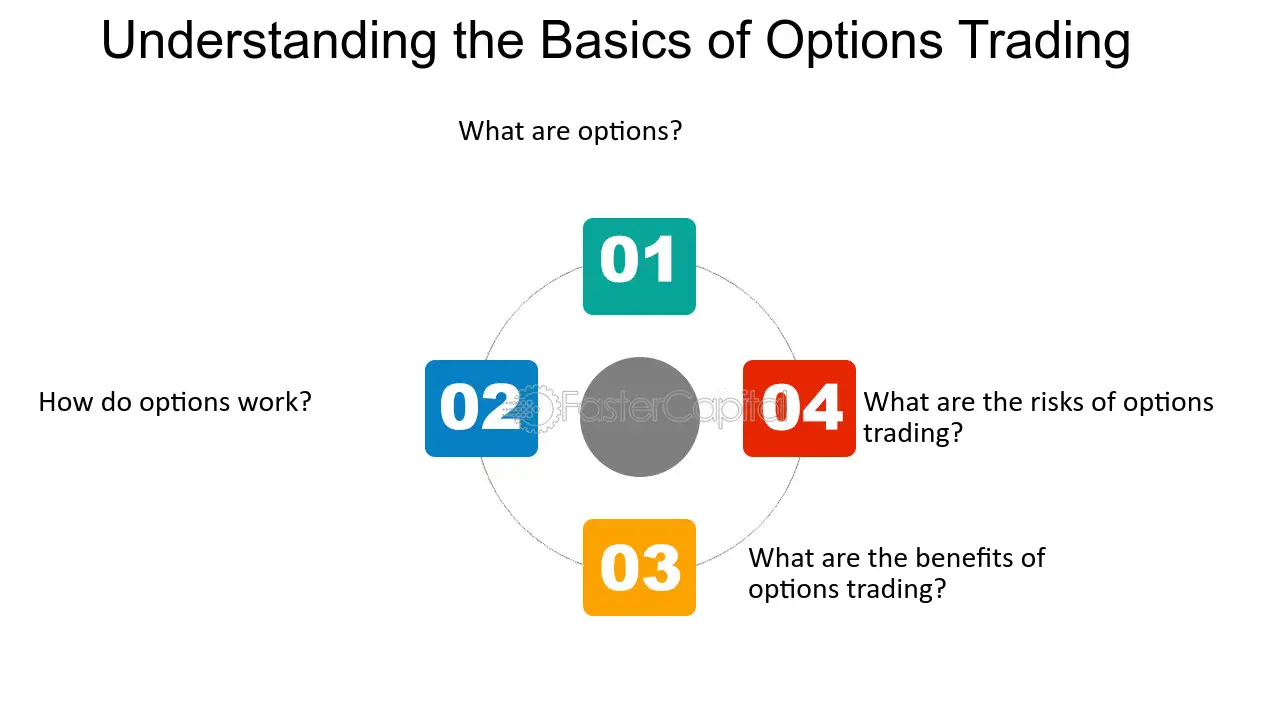

Understanding the Basics

The first step on your journey to trading is acquiring a firm understanding of the basics. This involves focusing your attention on the fundamental concepts of trading which includes understanding the different trading markets such as stocks, commodities, forex and more. Simultaneously, familiarizing yourself with the various trading platforms and tools available on the market will also prove to be beneficial alongside learning about risk management and how to analyze market trends.

Selecting the Right Broker

Once you’ve understood the fundamentals, the next step would be to select a reliable and suitable broker who will facilitate your trades. It’s important to choose a broker who offers a user-friendly platform, transparent pricing, and robust customer service. Keep in mind to also ascertain whether your chosen broker is regulated by relevant financial authorities to ensure a secure trading experience.

Creating a Trading Plan

Lastly, before embarking on your trading journey, you need to chalk out a well-planned trading strategy. This should outline your financial goals, the amount you are willing to risk, discipline, and the time you can dedicate to trading. Remember, consistency is key in the world of trading and the creation of a precise plan will assist in ensuring consistency.

Understanding the Risks: How Safe is Trading in Today’s Financial Market?

Understanding the Risks: How Safe is Trading in Today’s Financial Market? Unveiling the Secrets: Who is the Most Profitable Trader in the World?

Unveiling the Secrets: Who is the Most Profitable Trader in the World? Descubre Cuáles son las Mejores Estrategias de Trading para Maximizar tus Ganancias

Descubre Cuáles son las Mejores Estrategias de Trading para Maximizar tus Ganancias Exploring the Reasons: Why Am I Not Profitable in Trading?

Exploring the Reasons: Why Am I Not Profitable in Trading?